Platform of Possibilities.

PAIY® platform is an AI-based fintech software as a service (FaaS) to enable StartUp to Enterprise companies to build open-banking marketplace experiences.

The Opportunity

Much of the global market remains disconnected from needed financial services.

Lack of Capital

Lack of access working capital cause businesses to lose Billions* in annual sales

Lack of Services

Over 1.5B adults remain underserved* by any formal financial services

Lack of Tools

Both private and public sectors lack the right solutions to access new revenue streams

Fintech as a Service (FaaS)

A Banks’ back-end system that processes daily banking transactions and posts updates to accounts and other financial records. Retail banking provides financial services to the public which allows consumers to manage their money by giving them access to basic banking services, credit, and financial advice. Traditional Banking Systems are expensive and take many months to bring online – where mobile is an afterthought.

PAIY®.IO

Embedded FaaS apps for existing applications

Enterprises

KYC

Know-Your-Client Verification

Micro-Loans

Micro lending for small businesses and individuals.

Disbursements

Third-party payments

Flexible Technology

PAIY® is an intuitive, flexible technology that offers organizations the absolute best in fintech innovation to effectively grow their networks in geographically challenged areas … like blockchain for enhanced transaction and compliance auditing.

PAIY®.GLOBAL

Dedicated turnkey, adaptable Core Banking Software

Banks

Bill Pay

Card Issuance

CBDC/ Ledgers

Modular Architecture

PAIY Modules are deployed to:

- Cloud

- Multi-Cloud (2 or more clouds)

- Hybrid-Cloud (Cloud + On-Prem)

- On-Prem (local – Physical or Virtual)

- As highly encrypted modules

- Deployed tuned for Telcom-grade performance (10K TX / Second)

PAIY® TECH

SaaS Fintech for Virtual Card, Payments and Payroll

Governments

Payroll

Permits

Expense Disbursements

Cloud Platforms

PAIY® Tech works across multiple cloud platforms and carriers, facilitating numerous agent/broker set-ups (like Cardless ATM Services) and access to hundreds of financial products and services issued from our partner marketplace.

Turnkey Fintech.

4PAY enables rapid Fintech transformation

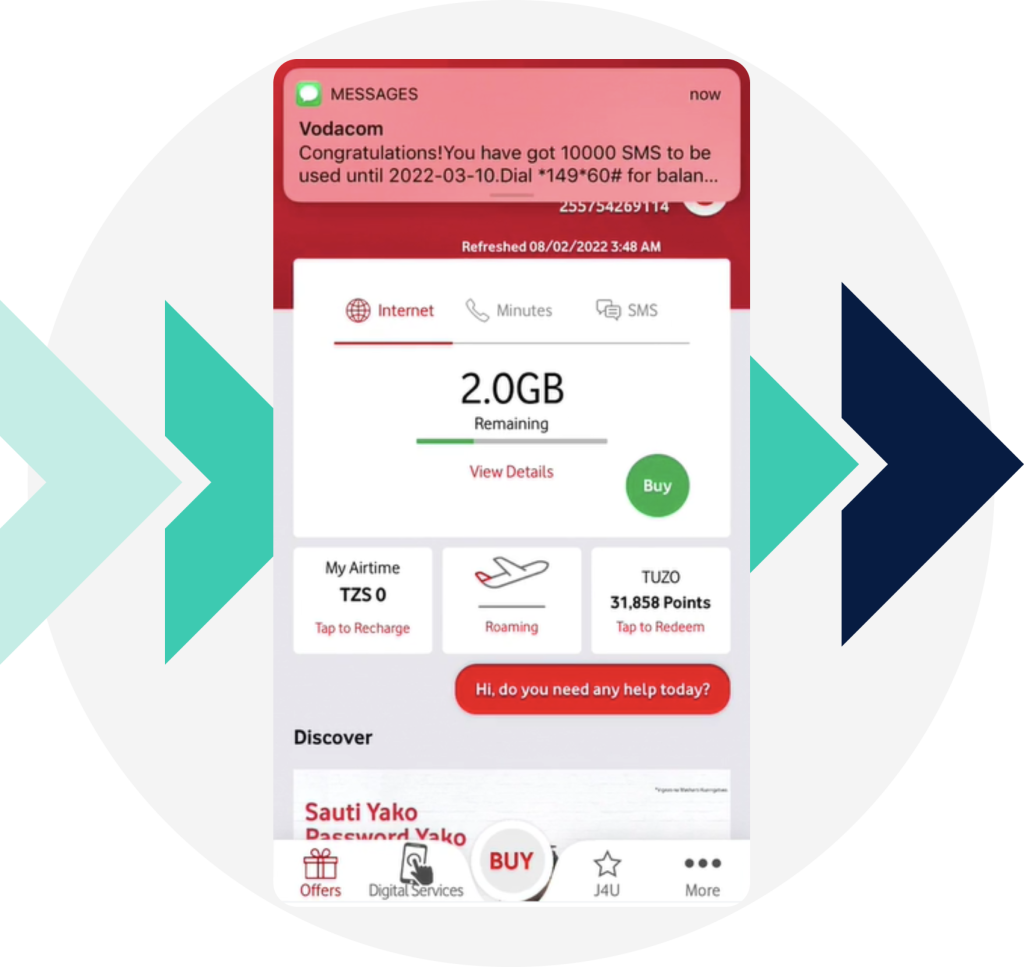

The Difference In Action

Vodacom MPESA uses Micro-loans to address liquidity gaps for businesses in Tanzania

BEFORE PAIY®

2+ days Micro-loan

1.7K loans issued daily.

6.1%+ default rate

TODAY with PAIY® IO

30 second Micro-loan

220K loans issued daily.

0.03% loan default rate

Links

User Agreement

Privacy Policy

Terms and Conditions

TORONTO

4PAY INCORPORATED

95 Mural Street, Suite 600

Richmond Hill, Ontario

L4B 3G2, CANADA

NEW YORK

4PAY US INC.

104 Charlton Street,

1-W (West Soho)

New York, NY 10014

DAR ES SALAAM

4PESA LTD.

NSSF NYERERE TOWER

3rd Floor, BIBI

TITI/MOROGORO ROAD

DAR-ES-SALAAM

TANZANIA